Credit: Covered California. Screenshot by: Derek Lin

Credit: Covered California. Screenshot by: Derek Lin

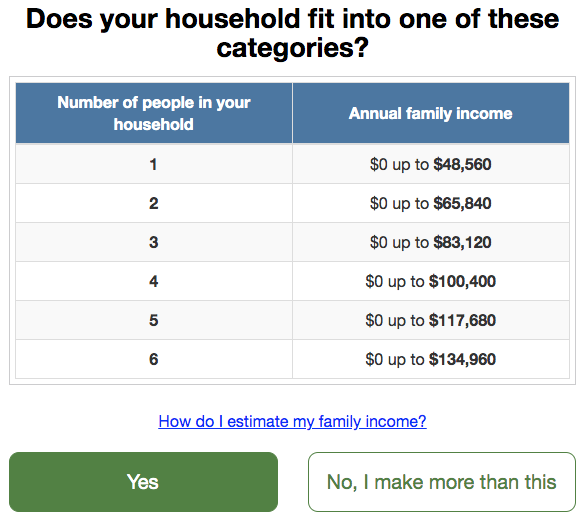

When you visit the Covered California website to see if you qualify for financial help, you can find the chart above. Let’s say you have three people in your family (including you), and your annual family income is less than or equal to $83,120; this means that you qualify for financial aid from the government. It means that APTC, or “advanced premium tax credit,” will be paid to the insurance company on your behalf. This can in turn tremendously help lower what you pay out-of-pocket for your monthly health insurance premiums.

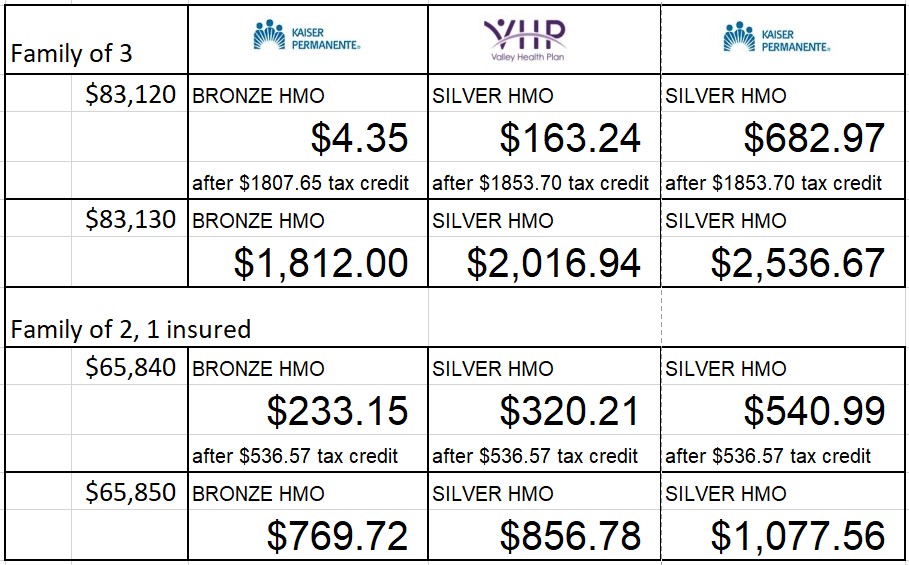

Now let’s take a look at two examples: a family of three consisting of a couple (ages 59 and 62) and their child (age 18), and a family of two consisting of a couple (ages 60 and 65) with the 65-year-old enrolled in Medicare.

Credit: Shop and Compare / Covered California. Version by: Charles Lee

Credit: Shop and Compare / Covered California. Version by: Charles Lee

As you can see in the table above, just a $10 difference in your taxable income—based on the thresholds defined—can make a huge difference to your out-of-pocket monthly premium.

If your income is way over the threshold for financial help, you can certainly afford the higher premium amounts. However, if your income is on the borderline of qualifying for financial help, paying attention to how you report it on your 1040 tax form is advised. Since every individual and/or family is different though, please consider contacting and consulting with us for your specific needs!