Index Universal Life Insurance (IUL) is an attractive life insurance solution that can provide a route to cash value accumulation and tax-free income potential. The cash accumulation is based in part on the movement of a major market index, with protection from loss due to market downturns. Her is an example to illustrate such product.

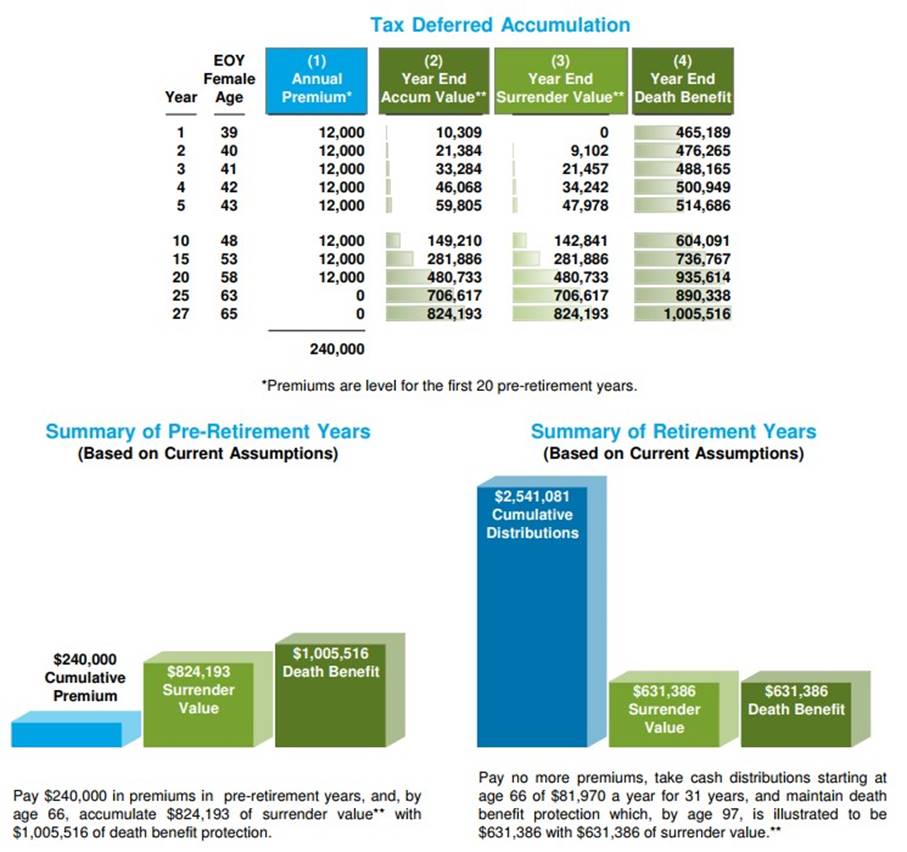

A female 38 of age very healthy, pays $1,000 per month for 20 years. She can purchase an IUL for an initial death benefit of $454,881.

By age 66, the cash value has accumulated to $824,193 with $1,005,516 of death benefit protection. Paying no more premiums, she can start taking tax-free cash distributions at age 66 of $81,970 a year for 31 years, and maintain death benefit protection which, by age 97, is illustrated to be $631,386.

On the other hand, if the same person, who instead adopts a strategy called “buys a term life insurance and invest the rest”.

With paying only $44.92 per month to a Term policy with the same death benefit of $454,881, she then puts the remaining 955.08 to an investment that grows 7.44% annual rate (same as the IUL insurance in this example). As shown in the illustration below, she also starts to take cash at age 66 of $81,970 a year out of her investment account. She will not have insurance by the age 73, and will run out of money in her account in the age of 84.

***Please note: the numbers shown in this example were calculated from the insurance company’s illustration software. It is for illustration purpose only. The actual numbers can be higher or lower.